"Hype or Hope?"

Editor's note: 漢娜·賴德(Hannah Ryder)是總部設在北京的國際發展咨詢公司Development Reimagined的首席執行官,曾任聯合國開發計劃署中國地區政策和伙伴關系負責人。

When I was growing up, my parents warned me about two things: Boys, and Debt. I grew up strongly aware that I was to avoid both, and to approach them with a lot of skepticism.

在我還小的時候,父母曾告訴我要警惕兩個問題:男人和債務。所以在成長過程中,我一直堅定地認為對這兩者要避而遠之,慎之又慎。

My husband, on the other hand, was told the opposite: search hard for a great partner, and - if you're investing in your home and future, stretch and raise as much debt as you can possibly manage.

而我丈夫學到的東西則正好相反:要努力找個好伴侶;還有,如果是為家庭和未來投資,只要能力允許,可以盡可能地舉債。

Now, happily married for 11 years, still working hard, having paid off our student loans, but still paying off our mortgage every month, I guess we found a healthy and happy balance to both partnerships and debt.

現在,我已經結婚11年了,生活幸福美滿。我仍在每天努力打拼。雖然已經還清了學生貸款,但每月還要還房貸。我想不論是在婚姻還是債務方面,我們都找到了一種合理的平衡。

But what is a healthy and happy balance to partnerships and debt for the government of an entire country like Kenya, where I was born? Should countries be cautious or should they be proactive, and stretch themselves?

但是,對于我的出生地肯尼亞這樣的國家來講,伙伴關系和債務的合理平衡是什么呢? 各國處理這些問題時,是該小心謹慎還是該積極主動、不遺余力呢?

Well, here is the challenge. Africa NEEDS a great deal of new infrastructure – from trains to power stations. But African governments are not large or rich enough to pay for this by themselves – they need external help as loans from either the private sector or other international partners to at least 63bn U.S. dollars per year, according to an estimate by the African Development Bank. The continent will also face additional costs due to climate change of 20–30 billion U.S. dollars per year. Asian and Pacific countries also need more debt, their "infrastructure gap" is estimated at around 250bn U.S. dollars per year.

這就是問題所在。從火車到發電站,非洲每年需要新建大量的基礎設施。但是,不論從規模還是財力上來看,非洲各國政府都不足以獨立支付這筆巨資,它們需要外部的幫助。根據非洲開發銀行的數據,非洲國家每年要從私有領域或其他國際伙伴那里獲得至少630億美元的貸款。由于氣候變化,非洲大陸每年還將面臨200億至300億美元的額外支出。亞太國家也需要更多的貸款。他們每年約有2500億美元的“基礎設施缺口”。

Just like my family, in order to grow, they HAVE to take on more debt.

就像我的家庭,為了實現經濟增長,這些國家不得不承擔更多的債務。

As an economist, I should know this. It's been shown in many studies that the more that countries spend on infrastructure, the more their economies grow.

作為一名經濟學家,我深以為然。許多研究表明,國家在基礎設施上的投入越多,其經濟增長也就越快。

The Chinese-built Maputo Bridge in Maputo, Mozambique, May 10, 2018. /Xinhua Photo

As a result, it's not the AMOUNT of debt that matters, it's the TYPE of debt that matters…In particular, is the debt going into projects that will be productive in the future?

因此,重要的不是債務的數量,而是債務的類型……尤其是,這些債務是否會用于為未來創造經濟價值的項目之中?

That's why the Kenyan president, in a recent interview with CNN said "What would worry me is if the debt was going into… paying salaries, or electricity bills, and so on. But what we have used our debt for is to close the infrastructure gap".

這就是為什么肯尼亞總統在接受CNN采訪時說:“如果債務真是用在了支付工資或電費等諸如此類的花銷上,我就會覺著擔心。可事實上,我們是用債務來彌補基礎設施缺口的。”

The good news is there is no shortage of productive infrastructure projects for China or others to invest in. In African countries, where over 600 million people don't have access to energy, renewable energy projects will enable young people to read and do their homework with light, enable factories to run better, without creating air pollution and climate change effects.

好消息是,有大量生產性基礎設施項目需要中國或其他國家來投資。在非洲國家,有超過6億人無法獲取任何能源。可再生能源項目將使青少年能夠在燈下閱讀和做功課,使工廠能夠在不污染空氣、不加劇氣候變化的前提下,實現更高效的運轉。

In Asia, green inner and inter-city transport are great investments – enabling more people to move around to seek jobs. In Latin America and the Caribbean, investment in tourism and transport will also deliver decent returns.

在亞洲,綠色的城內和城際交通都是絕佳的投資項目,有助于提高人口的流動性、促進就業,甚至也可能最后將貨物派送到各個港口。在拉丁美洲和加勒比地區,旅游和交通上的投資也將帶來不俗的回報。

Are these productive investments being prioritized by China and others? Not necessarily, for three reasons.

中國和其他國家都在優先考慮這些生產性投資嗎?并不一定,原因有三。

A lack of transparency can be the first reason. Governments should be conducting more due diligence of companies and companies themselves be more open. For instance, some companies – including from China – are still used for projects despite being on World Bank blacklists for corrupt practices. These blacklists may have shortcomings, but there are also opportunities for better performing companies to be chosen.

缺乏透明度可能是第一個原因。各國政府應該對公司開展更多的盡職調查。例如,一些公司(包括中國的公司)盡管因為腐敗問題被列入世界銀行的黑名單,但仍然參與了投資項目。這些黑名單可能有缺點,但也讓政府有機會選擇業績較好的公司。

The second reason is "tying". This is a policy used by many countries – including America, Japan and China - of requiring that loans or aid they give to other countries should go to a project that is built by their own companies. This type of securing "win-win" can be helpful to ensuring projects get done quickly and even avoid corruption. But tying can also create massive conflicts of interest, shifting the focus away from the poor people that the finance is meant to help. However, many countries – including the U.S. and Japan – are reluctant to stop tying.

第二個原因則是“搭售”。這是許多國家(包括美國、日本和中國)使用的一項政策,規定發放給其他國家的貸款須用在本國公司的承建項目上。這種政策雖然在工程建設速度和避免腐敗方面可以確保“雙贏”的局面,但也可能造成嚴重的利益沖突,而且不一定有利于貸款原本想要資助的窮人。但包括美國和日本在內的許多國家都不愿意停止這種政策。

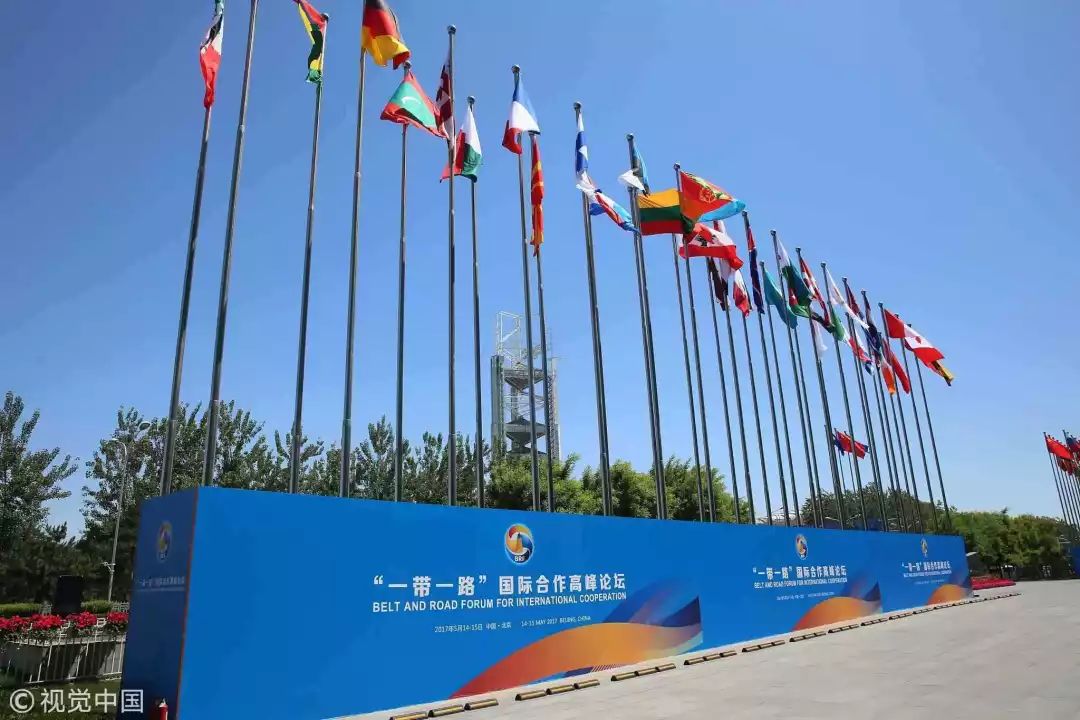

The first Belt and Road Forum for International Cooperation was held in Beijing in May 2017. /VCG Photo

That said, through its most recent Foreign Investment Law, China has made a landmark move by opening up domestic government procurement to foreign firms. Hopefully this principle will also be applied to projects supported by China abroad and thereby "untie" them.

而通過最近頒布的《外商投資法》,中國向外國公司開放國內政府采購,這是一項具有里程碑意義的舉措。希望這一原則也能適用于中國在海外支持的項目。

The third and final reason why the most productive projects may not be picked is a lack of leadership. Governments need to work much harder to prioritize the most sustainable and green projects that their citizens need and in a manner they want - including using local companies, local materials and local labor.

高效基建項目不被投資的第三個原因是缺乏領導力。各國政府需要加倍努力,優先開展本國人民所需的、最具經濟前景和環保價值的項目,并自主選擇項目的開展方式,包括發揮當地企業的作用,利用當地原材料和勞動力。

As the 2nd belt and road forum takes place here in Beijing, my hope is that the discussion about debt in poor countries will be less about debt from China or the amount, but more about better debt from everyone. Indeed, China's offer of 100bn U.S. dollars a year is less than 10 percent of the total infrastructure gap for poor countries around the world. Poor countries will still have to look beyond China.

第二屆一帶一路峰會召開在即,我希望針對窮國債務問題的討論不再集中于減少從中國或其他國家借貸這一話題,而是更多地關注優質債務的獲取。事實上,中國的“一帶一路”倡議每年提供的1000億美元資金只占全球最貧窮國家每年所面臨的缺口的大約10%。所以,貧窮國家仍然需要從中國以外的地區尋求資金。

With the BRI, and new global funds like the Asian Infrastructure Investment Bank, Americas new infrastructure fund called BUILD, and a new infrastructure facility for the Pacific from Australia, there is a great opportunity ahead for everyone.

中國提出了“一帶一路”倡議,新的全球基金也紛至沓來,例如亞洲基礎設施投資銀行,美國的BUILD基礎設施基金,以及澳大利亞為太平洋地區提供的基礎設施建設基金。這些將為所有國家帶來巨大機遇。

Let's not be as cautious as my parents told me to be. The world will not be able to meet the UN's Sustainable Development Goals unless poor countries get more cheap loans. But like the loans that my husband and I took out to fund our future, let's work hard to make sure the debt is productive as quickly as possible.

我們不必像我父母教我的那樣謹小慎微。如果貧窮國家無法獲得更多的低息貸款,聯合國可持續發展目標就無法實現。但是,正如我和我丈夫為我們的未來貸款一樣,讓我們共同努力,確保債務盡快轉化為生產力。

第六批在韓志愿軍烈士遺骸被接運回國

第六批在韓志愿軍烈士遺骸被接運回國